Protecting an Equity Loan: Actions and Needs Discussed

Protecting an Equity Loan: Actions and Needs Discussed

Blog Article

The Leading Reasons House Owners Select to Protect an Equity Funding

For lots of property owners, choosing to safeguard an equity loan is a calculated monetary choice that can supply numerous advantages. The ability to take advantage of the equity constructed in one's home can offer a lifeline throughout times of monetary need or offer as a tool to achieve details goals. From consolidating financial debt to taking on major home renovations, the factors driving individuals to select an equity finance are impactful and diverse. Recognizing these motivations can clarify the sensible financial planning that underpins such selections.

Debt Consolidation

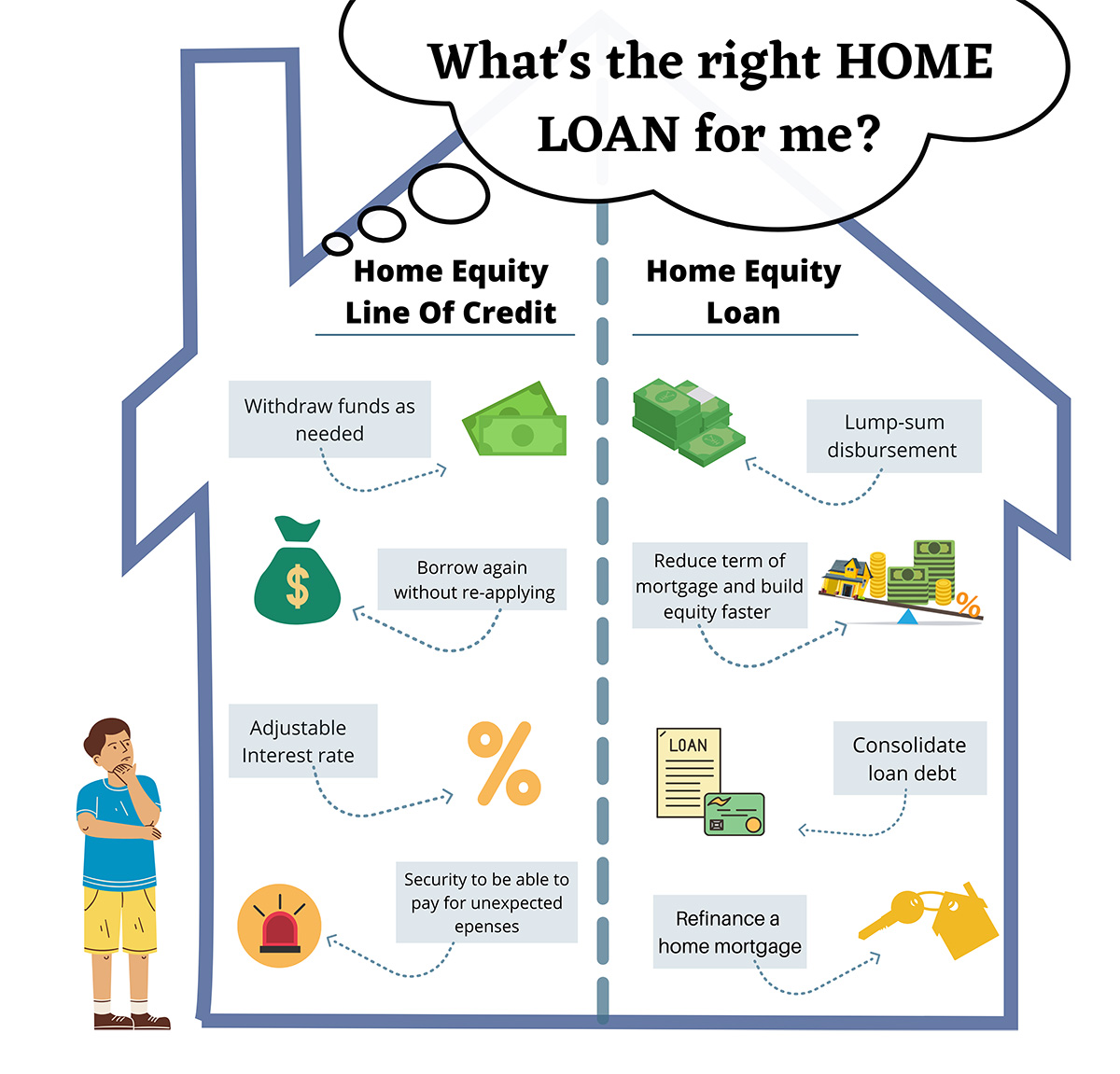

House owners commonly choose protecting an equity lending as a calculated financial step for debt loan consolidation. By leveraging the equity in their homes, people can access a round figure of cash at a lower rates of interest compared to various other kinds of borrowing. This funding can after that be made use of to pay off high-interest financial obligations, such as bank card equilibriums or personal fundings, permitting homeowners to improve their monetary obligations into a solitary, extra manageable month-to-month payment.

Financial obligation loan consolidation via an equity financing can supply numerous advantages to house owners. To start with, it simplifies the payment process by integrating several financial obligations into one, minimizing the danger of missed repayments and prospective penalties. Secondly, the lower rate of interest connected with equity financings can cause considerable expense savings over time. Furthermore, combining financial obligation in this manner can boost a person's credit report by decreasing their general debt-to-income proportion.

Home Improvement Projects

Taking into consideration the improved worth and performance that can be achieved with leveraging equity, numerous people choose to allocate funds in the direction of different home renovation jobs - Alpine Credits. Home owners usually select to protect an equity financing particularly for restoring their homes because of the substantial rois that such tasks can bring. Whether it's upgrading obsolete attributes, increasing space, or enhancing power efficiency, home renovations can not only make living rooms much more comfy however additionally boost the overall value of the home

Common home renovation projects funded via equity finances include kitchen area remodels, bathroom restorations, cellar completing, and landscape design upgrades. These tasks not only enhance the lifestyle for house owners but also add to boosting the visual charm and resale worth of the residential or commercial property. In addition, purchasing premium products and modern style components can even more boost the aesthetic charm and functionality of the home. By leveraging equity for home improvement jobs, homeowners can create rooms that much better match their needs and preferences while likewise making a sound monetary investment in their residential or commercial property.

Emergency Expenses

In unexpected circumstances where instant economic assistance is required, securing an equity funding can provide property owners with a viable solution for covering emergency situation costs. When unexpected events such as clinical emergencies, immediate home repair services, or unexpected job loss emerge, having accessibility to funds through an equity loan can supply a safeguard for home owners. Unlike other forms of loaning, equity fundings generally have reduced rate of interest and longer payment terms, making them an affordable alternative for attending to immediate monetary needs.

One of the key advantages of making use of an equity funding for emergency costs is the speed at which funds can be accessed - Alpine Credits Canada. Property owners can quickly take advantage of the equity built up in their property, permitting them to attend to pressing economic issues without hold-up. Furthermore, the flexibility of equity financings allows homeowners to obtain only what they require, avoiding the worry of handling too much financial obligation

Education And Learning Funding

In the middle of the quest of college, securing an equity car loan can work as a critical monetary resource for homeowners. Education and learning financing is a considerable issue for numerous families, and leveraging the equity in their homes can give a means to gain access to required funds. Equity lendings often offer reduced rate of interest rates contrasted to various other types of lending, making them an attractive option for financing education expenses.

By tapping into the equity accumulated in their homes, home owners can access significant amounts of money to cover tuition costs, books, accommodation, and various other associated costs. Equity Loans. This can be particularly valuable for parents looking to sustain their children with college or individuals looking for to advance their very own education. In addition, the rate of interest paid on equity loans might be tax-deductible, providing prospective economic advantages for consumers

Eventually, making use of an equity car loan for education and learning funding can aid individuals purchase their future earning possibility and profession improvement while effectively managing their economic obligations.

Investment Opportunities

Conclusion

To conclude, home owners choose to protect an equity financing for various reasons such as financial debt consolidation, home enhancement jobs, emergency situation expenses, education funding, and financial investment possibilities. These finances provide a way for house owners to gain access to funds for vital financial needs and goals. By leveraging the equity in review their homes, property owners can benefit from reduced rates of interest and flexible repayment terms to achieve their financial objectives.

Report this page